| No matching records found | |

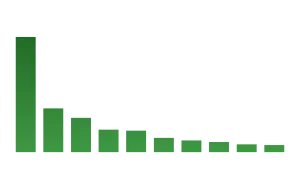

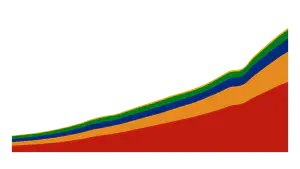

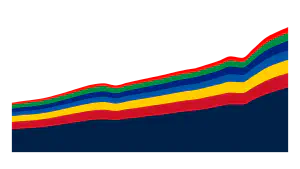

The fiscal history of the United States from 1901 to 2024 reflects a dynamic interplay between government revenues and expenditures, influenced by wars, economic cycles, and policy decisions. Throughout this period, the federal budget has oscillated between surpluses and deficits, with deficits occurring more frequently. Specifically, over the 119 years since 1901, the federal budget recorded deficits in 89 years (75% of the time) and surpluses in only 30 years (25%).

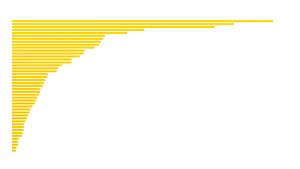

In the early 20th century, the U.S. experienced modest budget surpluses during periods of economic growth and relative peace. For instance, from 1901 to 1916, the federal budget often reflected small surpluses, with revenues exceeding expenditures in several years. However, this trend reversed dramatically during World War I, as military spending surged, leading to significant deficits from 1917 to 1919. Post-war years saw a return to surpluses throughout the 1920s, as the government reduced spending and benefited from economic prosperity.

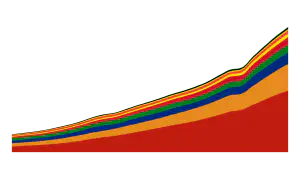

The Great Depression of the 1930s prompted increased government spending under New Deal programs aimed at economic recovery, resulting in budget deficits during most of that decade. World War II further exacerbated deficits, with unprecedented military expenditures pushing the federal budget deep into the red from 1942 to 1945. In the immediate post-war period, the government achieved surpluses as military spending decreased and the economy expanded, notably from 1947 to 1949.

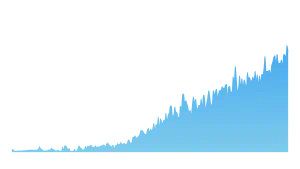

From 1950 onwards, deficits became more common, reflecting increased spending on social programs, defense during the Cold War, and responses to economic downturns. Despite periods of economic growth, the federal budget recorded deficits in 61 out of 70 years between 1950 and 2019, underscoring a persistent trend of expenditures outpacing revenues. Notable exceptions include the late 1990s, when a combination of economic growth, tax revenues, and controlled spending resulted in budget surpluses from 1998 to 2001.

In recent years, the federal budget has continued to reflect substantial deficits. For instance, in Fiscal Year 2024, government spending totaled $6.75 trillion, while revenues were $4.92 trillion, resulting in a deficit of $1.83 trillion. This ongoing trend highlights the challenges in balancing the federal budget amidst economic fluctuations, policy decisions, and unforeseen events impacting government finances.